A couple have confessed to living paycheck to paycheck despite earning $200,000 and having multiple income streams

A couple has claimed their spending has continued to get out of control over the years despite them having well paying jobs.

Many people are feeling the pinch at the moment as the cost of living continues to worsen.

However, a couple who earn significantly more money than the average American have claimed that they are living paycheck to paycheck.

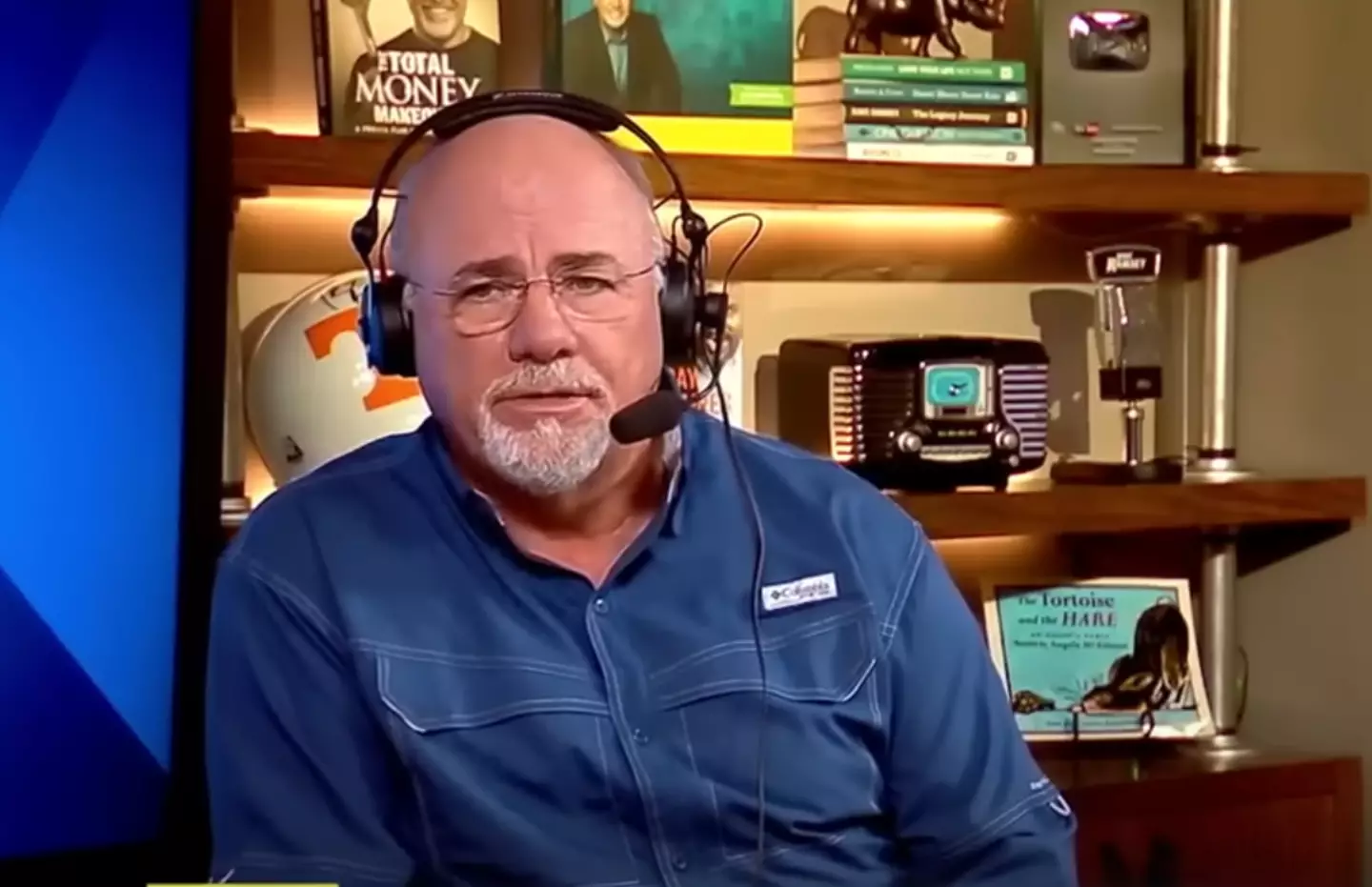

A financial advisor, Dave Ramsey, admitted to being shocked at their finances as he spoke to the couple on his podcast.

Ramsey said the couple had fallen into ‘lifestyle creep’ which he explained as when a person ramps up their spending faster than their income coming in.

Ramsey said the couple had fallen into ‘lifestyle creep’ which he explained as when a person ramps up their spending faster than their income coming in. (The Ramsay Show/YouTube)

The couple have said they are in a whopping $800,000 of debt… which explains the living paycheck to paycheck bit.

The pair are also both working, have rental properties that generate additional income and live in relatively cheap Midwestern city, Des Moines, Iowa.

Ramsey learned that husband and wife earning a base salary of $175,000 and bringing in an additional $20,000 from rental properties. For context, the median US household income was $74,580 in 2022, according to Census data.

To cut down on the debt, husband Aaron has said he is considering selling the rental property which is worth $325,000.

Explaining their spending Aaron said: “Less than a year ago my salary doubled, and we just kinda went crazy.” (Getty Stock Image)

However, his wife is reluctant due to emotional ties and not believing in living life debt-free.

Explaining their spending, Aaron said: “Less than a year ago my salary doubled, and we just kinda went crazy.”

The couple have $450,000 outstanding mortgage debt on their main home and a further $192,000 on an investment home. As well as this, between them the couple have mix of personal loans, car loans, student loans, and credit card debt.

“You guys are seriously broke!’ Ramsey declared upon analyzing the couple’s situation.

“You’ll are freaking starving to death making $200,000 and spending like you’re in Congress.

“You have a pretty serious level of denial inside your household. I think I am more upset about this than you are.

“I think the two of you need to understand you can’t live like this. This is ridiculous. You’re working your butt off and going backwards.”

He also warned against spending to keep up appearances and said not caring what other people think is a great super power.

We can only hope this very wealthy couple is able to find a way to get by in these difficult financial times that everyone is facing.